Digital Banking Upgrade

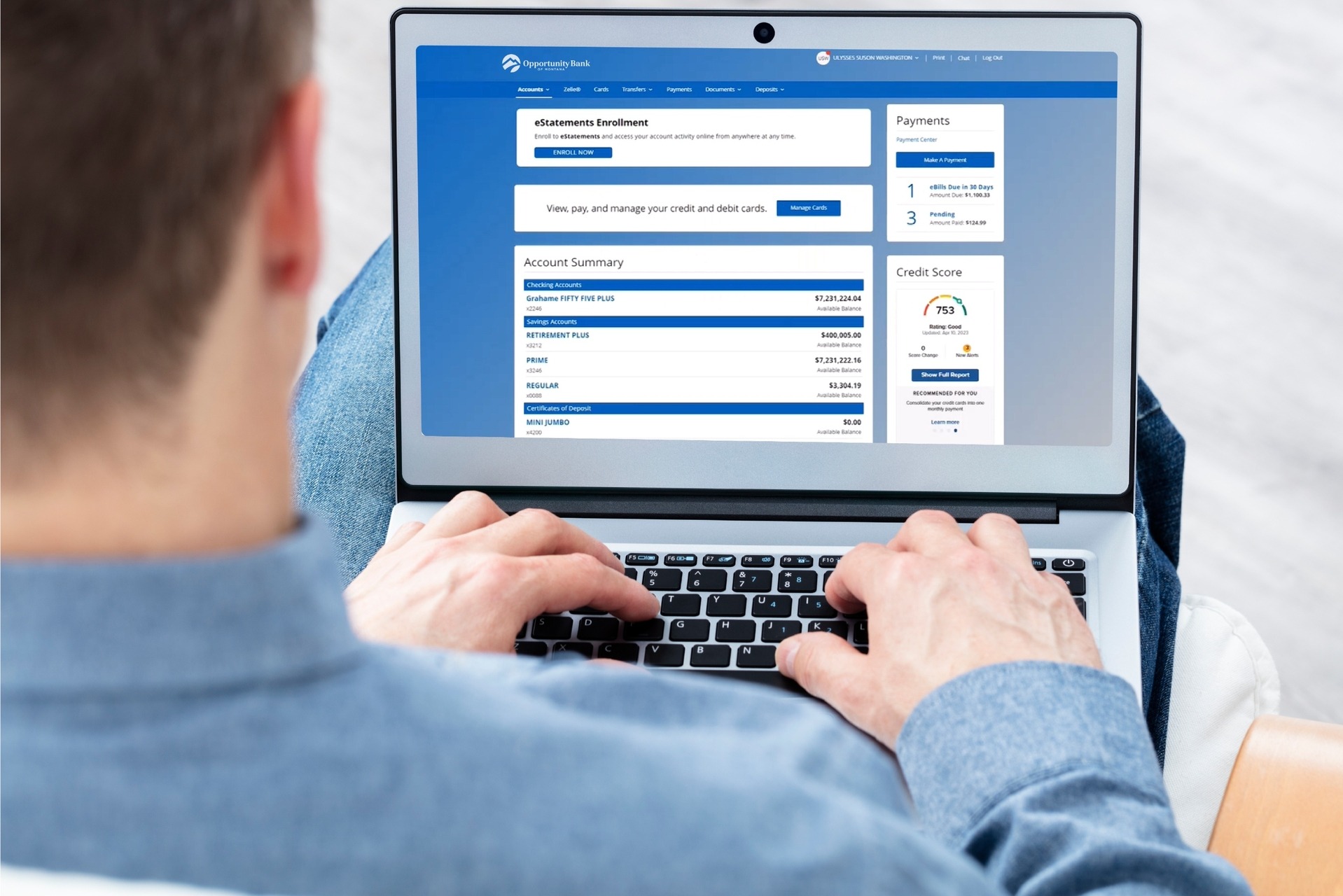

At Opportunity Bank

of Montana, we know your time is valuable – and your banking should be simple,

secure and convenient. Our enhanced digital banking experience is designed to

meet your needs, whether you’re at home or on the go. With one platform for both

personal and business banking, everything you need is in one place.

A New Era of Banking is Here

Opportunity Bank’s enhanced

digital banking platform is now live, designed to bring you more convenience,

stronger security, and a seamless experience across all your devices.

Simplified Digital Banking for Business Users

Our enhanced digital banking platform is now live, bringing business users a streamlined experience with one secure login for both personal and business accounts.

Have questions as your get started? Contact your local branch or email us at digitalbanking@oppbank.com.

Need Help? We’ve Got You Covered

We understand that upgrading to a new digital banking platform may raise questions – That's why we're here to support you every step of the way.

Helpful how-to-videos are available to guide you through the new experience.

If you need

assistance, contact your local branch, use live chat after

logging in to the upgraded platform, or find the live chat link on our Help/FAQs

page.

Resources and FAQs

Here you will find information to help you prepare for the digital banking upgrade, including instructions and answers to common questions. We encourage you to review these resources before the upgrade and check back for updates as we continue to share new information during the transition.

Resources

- New Personal User Registration Guide - This guide is for first-time users on how to register for our new digital banking platform.

- New Business User First-Time Login Guide - This guide will walk new business users through the first-time login process.

- QuickBooks Desktop Upgrade Instructions

- QuickBooks Online Upgrade Instructions

- Quicken Upgrade Instructions

No. The old URL will no longer work. Please be sure to use our new digital banking login page to access your account. For the best experience, update any saved bookmarks or favorites to your browser with the new login link.

No. You’ll continue to use your existing user ID and password.

- If you are unsure of your user ID, contact your local branch.

- If you are unsure of your password, select “Forgot Password” on the login screen and follow the prompts or contact your local branch.

- Business users: If you are unsure of your user ID or password, please call us at (888) 750-2265.

If you already use the Opportunity Bank of MT Mobile app, it may automatically update depending on your phone settings. If it doesn’t update automatically, visit your app store and manually update the app.

Business banking app users will need to download the Opportunity Bank of MT Mobile app from the app store and delete the Opportunity Bank Business app.

If you see a message that the app isn't supported, this may mean your phone's software needs to be updated in your settings. After you update your device, try downloading or updating the app again.

You’ll need to log in manually the first time after the upgrade. After that, you can re-enable Face ID or Fingerprint Recognition login in your app settings.

Two-factor authentication is a security measure that adds an extra layer of protection to your digital banking account.

You will receive a one-time passcode via text or phone call to verify your identity during your first login or when logging in from an unknown device.

The account will use the primary phone number associated with the account holder for the two-factor authentication process.

For shared accounts (e.g., spouses or small business owners), this may affect the login process. We recommend each authorized user have their own login for a more secure experience.

To create a new personal account login, visit the digital banking website and enroll as a new user.

In order to create a business account login, contact your local branch for more information.

Your bill payees and scheduled bill payments will transfer to the new platform. However, we recommend reviewing all scheduled payments after your first login.

While most of your banking tools will transfer over, a few settings will need to be reestablished. This is a great opportunity to personalize your digital banking experience on the upgraded platform.