Understanding your Escrow Account

Opportunity Bank of Montana conducts an annual escrow analysis on your account to determine if the escrow portion of your monthly payment is enough to cover your real estate taxes and/or insurance. This page is intended to assist you as you closely review your escrow analysis, or Annual Escrow Account Disclosure Statement.

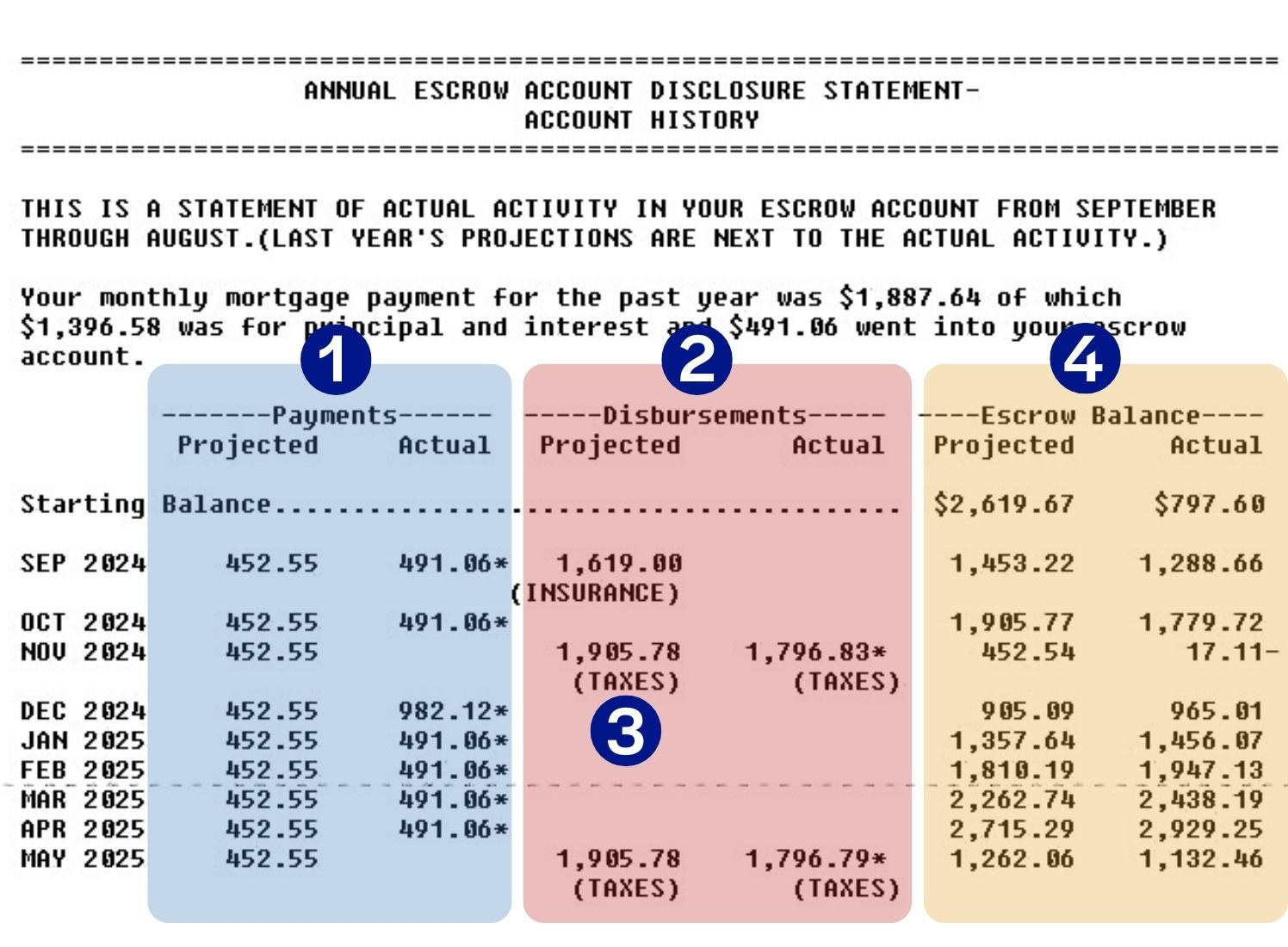

Account History

This chart shows all of your escrow activity from the past year, including what was originally projected and what was actually paid.

- Payments to Escrow Account: The Projected column outlines the estimated payments coming into your escrow account. The Actual column outlines actual payments deposited into your escrow account.

- Disbursements from Escrow Account: The Projected column outlines original projected amount to be disbursed from escrow. The Actual column outlines actual amount disbursed from escrow.

- Projected/Actual Escrow Description: Description of the item paid from your escrow account (i.e. taxes, insurance, etc.).

- Escrow Balance Comparison: The Projected column shows the originally projected escrow balance after each payment or disbursement. The Actual column shows the actual escrow balance after each payment to or disbursement from escrow.

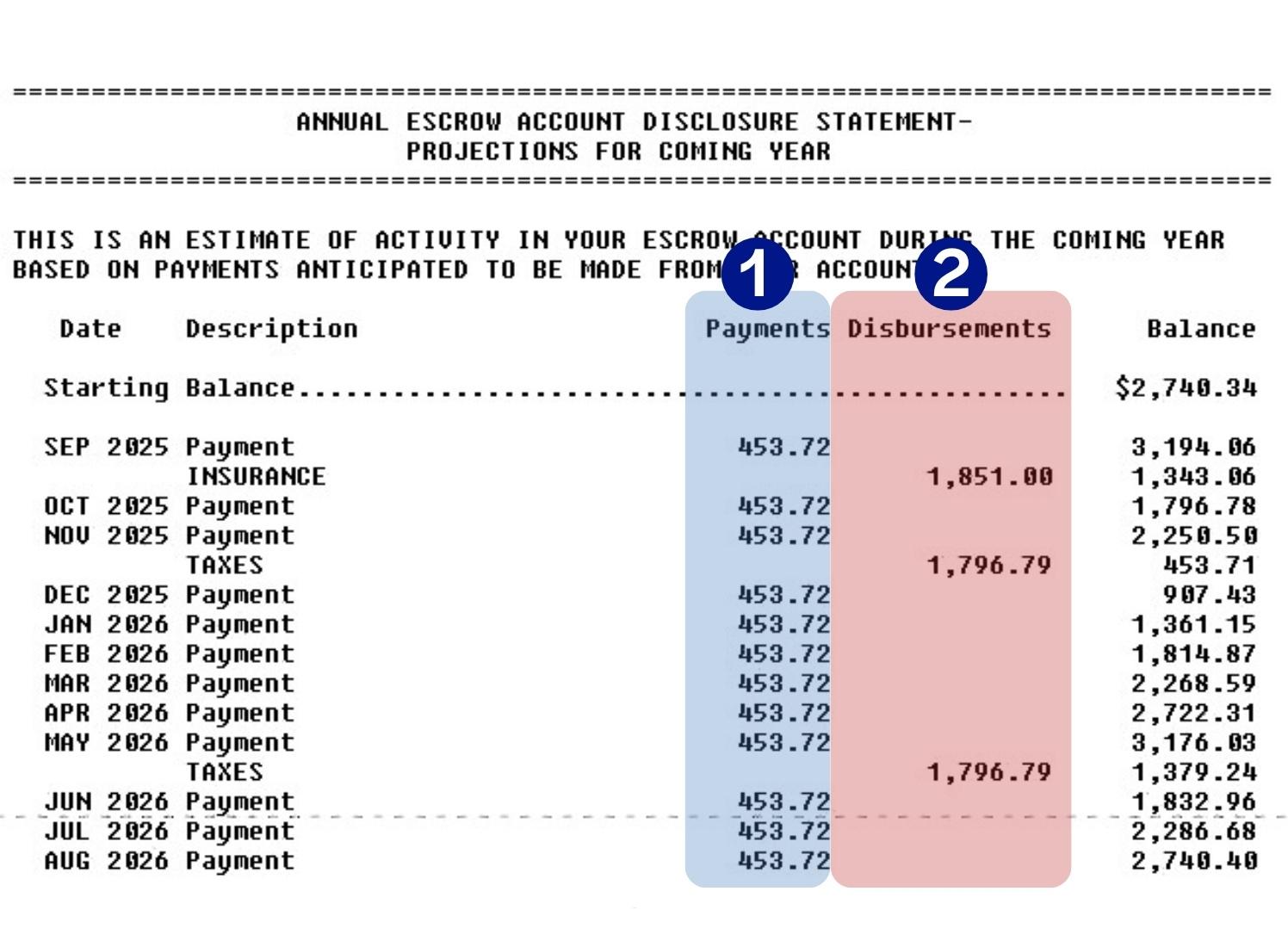

Projections for the Coming Year

This chart shows your estimated escrow payments (both to and from your account) for the upcoming year. These estimated amounts are based on your current tax and insurance payments. If these expenses increase or decrease during the upcoming year, your actual payments may also change.

- Payment Information: This is a breakdown of the anticipated total monthly escrow amount from the monthly mortgage payment for the next 12 months, along with the effective date of the change in your total monthly payment if no action is taken to reduce it.

- Anticipated Escrow Account Disbursements: These are the estimated amounts to be paid from escrow for your taxes and insurance over the next 12 months.

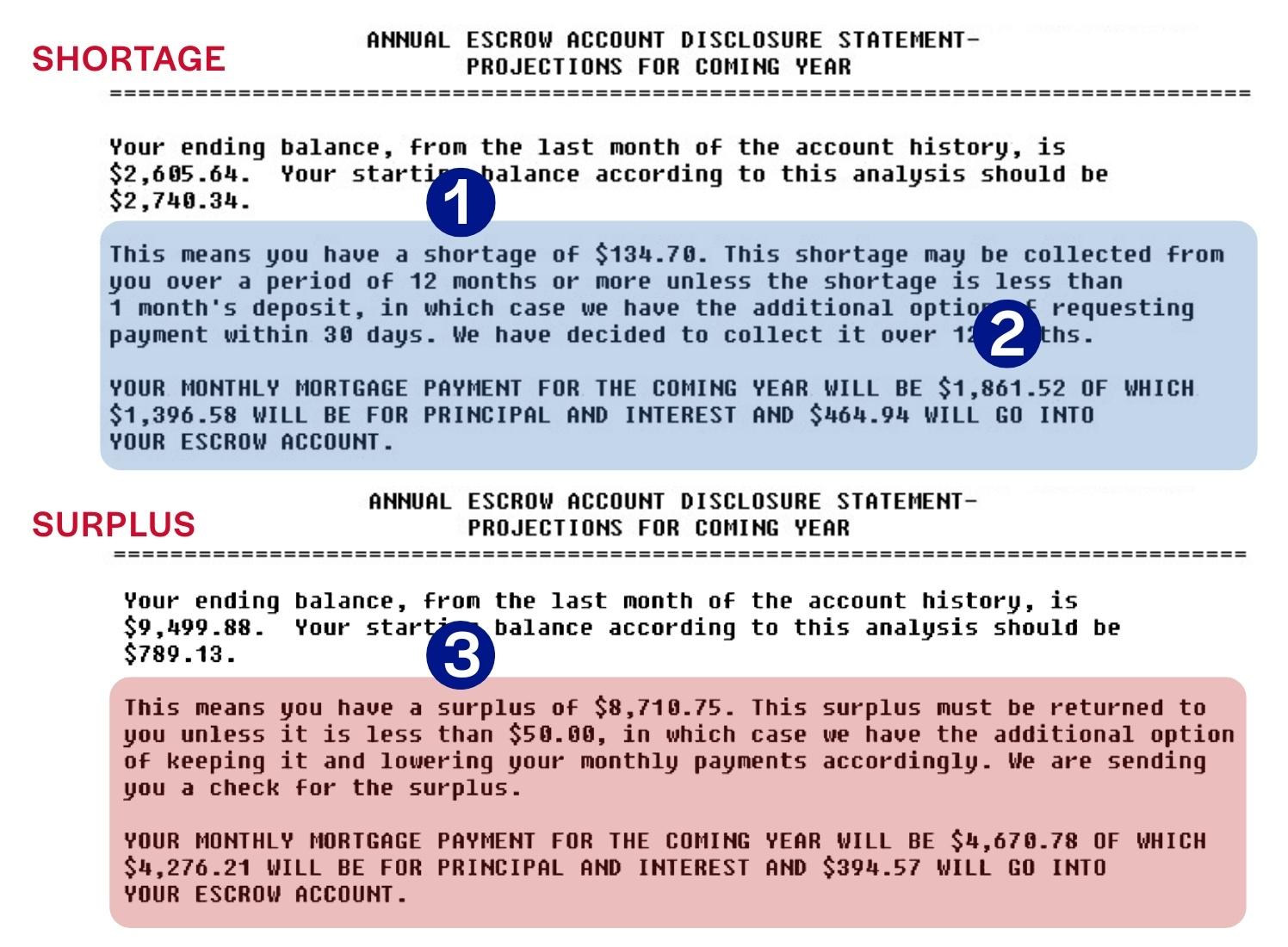

Ending Balance

Shortage or Surplus

Your escrow account may end the year with either a shortage or a surplus.

- Escrow Shortage and/or Deficiency (if applicable): The value of any escrow shortage and/or deficiency will be listed here.

- New Monthly Mortgage Payment: Find your updated monthly payment for the coming year, including how much goes toward principal, interest, and escrow.

- Escrow Surplus (if applicable): If your escrow has a surplus of $50 or more, your analysis statement will include a surplus check.

Shortage and/or Deficiency Payment Options:

If you have an escrow shortage and/or deficiency, you have two options to consider covering the difference:

If you have an escrow shortage and/or deficiency, you have two options to consider covering the difference:

- Option A: No Action Required. The shortage and/or deficiency will automatically spread over the indicated number of months outlined in the Escrow Account Projection for the Coming Year section of your analysis.

- Option B: Pay your shortage and/or deficiency in full. Please note that even if your shortage and/or deficiency is paid in full, your payment may still increase. Payment must be made by the 15th of the month.

Frequently Asked Questions

Increases and decreases to the escrow portion of your monthly payment are typically the result of changes in your real estate taxes and/or insurance. Some possible reasons are:

- Homeowners insurance: Your premium may be different because of changes to the type or extent of your insurance coverage, or if your insurance company changed your insurance rate. We encourage you to contact your insurance company or agent for any questions regarding changes to premiums.

- Real estate taxes: Your real estate taxes may be different because of a property reassessment, or if the tax rate has changed. Tax bills for special assessments charged by your local tax authority will also impact the amount we collect for your real estate taxes. Anticipated tax payment time frames may change per local authority as well. We encourage you to contact your local county treasurer’s office for any questions regarding changes to your real estate taxes.

- New construction: A difference may occur with partially assessed real estate tax bills for new construction properties. Typically, the first tax bill for a new property is only for the land/lot. Then, as the property is assessed, the real estate tax bill may increase to include the land and the structures.

- Initial escrow deposit: Escrow is sometimes estimated at the loan closing because final information may not be available at that time. If the amount collected for the setup of your escrow account was more or less than the actual bills received for real estate taxes and/or insurance premiums, this will cause your monthly mortgage payment to change.

A deficiency is the amount of a negative balance in an escrow account.

A shortage is an amount a current escrow account balance falls short of the target balance at the time of the escrow analysis.

You

can make an escrow payment using one of the following methods:

- Log in to your Digital Banking account

- Visit any Opportunity Bank of Montana branch

- Mail your payment to PO Box 4999, Helena, MT 59604

No, you will need to update any online transfers you have set up. Our team can help set up an automatic payment that will update if and when your payment changes. Contact us at 1-888-750-2265, or visit your local branch for an automatic transfer form.

Unfortunately, no. Even if the shortage and/or deficiency is paid upfront, the escrow payment must increase enough to cover the new real estate tax and/or insurance amounts. However, when a shortage or deficiency is paid upfront, the escrow payment will not increase as significantly.

Opportunity

Bank requires payment in full to avoid late fees. To avoid a late fee, the payment must be received by the 15th day of the month in which it is due. Late payments may be subject to negative credit reporting if they are not satisfied by the end of the payment cycle.

We are required to send you a surplus check when there is a surplus. You may deposit those funds in your personal account or place the funds back in your escrow account to help prevent a potential shortage and/or deficiency the next time this analysis is completed.

Yes, you can deposit funds into your escrow account at any time. By doing so you may prevent a possible future shortage and/or deficiency.

Your mortgage documents allow us to maintain an escrow cushion. This cushion is the minimum balance of the escrow account and acts like a reserve account to help if your taxes or insurance increase.

Who do I contact if I have questions?

Escrow or account information:

Contact

the Opportunity Bank of Montana Loan Servicing Escrow team at 406-457-4063 menu option number 2.

Taxes:

Contact your local county treasurer’s office.

Insurance:

Contact your insurance company or agent.